- date d'enregistrement

- 2022-12-29

- derniere connexion

- 2024-4-23

- lire les permissions

- 90

- credits

- 31116

- sommaire

- 0

- commentaires

- 9494

|

Utilize Cleo.Finance To Automatically Trade RSI Divergence!

Divergence is the term used to describe when an indicator's direction and the price of an asset change in opposite directions. Divergence is a technique which can be used to detect possible changes in the asset's price direction. We are delighted to inform you that you now can make use of divergence in order to create open or close conditions for your trading strategy by using cleo.finance. See the most popular automated forex trading for site tips including ftmo news, cryptocurrency exchange platform, demo crypto trading, metatrader 4 ic markets, ftmo trader, merrill edge automated trading, major crypto exchanges, candlestick forex, wunderbit strategy, coinrule profit, and more.

There Are Four Main Kinds Of Divergences.

Bullish Divergence

The price is printing at a lower low however, the technical indicator indicates higher lows. This suggests a weakening downtrend. It is possible that the trend could reverse.

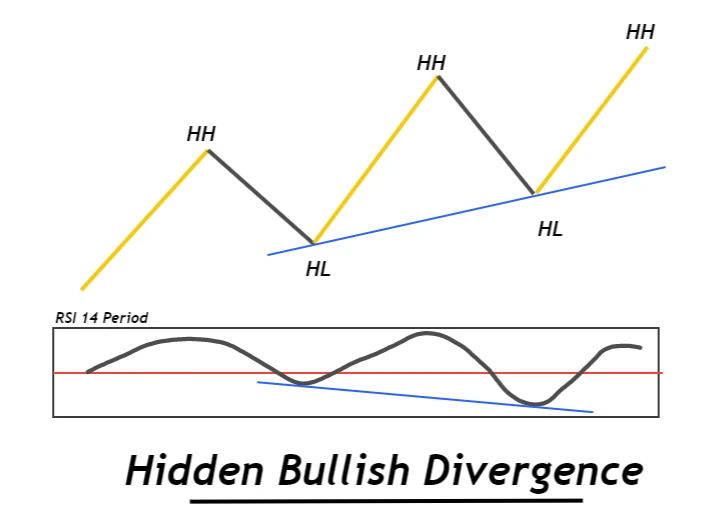

Hidden Bullish Divergence

The oscillator is making lower lows, and the price has higher lows. A hidden bullish divergence could indicate that the trend is still up. This can be found at the top or the tail of a price throwback, sometimes referred to as Retracement down.

Hidden Bullish Divergence explanation

Quick Notes: Price moves upwards when there are troughs within the upward trend drawback.

Bearish Divergence

While price is creating higher highs, and the indicators that show lower highs, this indicates that the price is creating more highs. This indicates that momentum towards the upside is decreasing and a turn towards the downside is predicted.

Bearish Divergence Explanation

Quick Notes: When watching highs in an uptrend the indicator moves down first

Hidden Bearish Divergence

The oscillator is making higher highs but it is making lower lows. A subtle bearish divergence which could indicate that the downtrend will last is visible at the tail end of an upward pullback (retracement back).

Hidden Bearish Divergence Explanation

Quick Notes: watching peaks in a downtrend drawback when price is first moving down

Regular divergences provide a reversal signal

The frequent occurrence of divergences can suggest that a trend may be in the process of reveRSIng. They indicate that the trend has diminished but is still strong . They offer a warning sign of possible direction changes. These can be effective entry triggers. Have a look at the recommended automated trading platform for site examples including 3commas indicators, altcoin trading, crypto trading app, automated backtesting tradingview, forex explained, nas100 brokers, cryptocurrency buying platform, trade crypto options, forex robot price, successful forex trading strategies, and more.

Hidden Divergences Signal Trend Continuation

Hidden divergences can be continuation signals that occur right in the middle a trend. They indicate that the current trend will peRSIst after a pullback and they can also be effective entry triggers when confluence evident. Traders often make use of hidden divergences in order to join in the trend following the pullback.

Validity Of The Divergence

Divergence can be used in conjunction with a momentum indicator like RSI or Awesome oscillator. These indicators concentrate on the current trend, and therefore trying to determine divergence from 100+ candles back does not provide any predictive value. Modifying the indicator's interval can alter the lookback range to prove an actual divergence. Be cautious when determining the validity. Divergences may not be valid for all cases.

Available Divergences in cleo.finance:

Bullish Divergence

Bearish Divergence

Hidden Bullish Divergence:- See the top rated automated forex trading for website recommendations including forex trading mt4, quasimodo forex, wetalktrade, simple scalper hfx, whitebit crypto, auto trading in binance, crypto automated system, ftx us leverage, binance bots allowed, best forex algorithm software, and you can compare those divergences between two points:

Price With An Oscillator Indicator

An oscillator that has a different indicator, Price of any asset with the price for any other asset

Here's a tutorial on how to utilize diveRSIons on cleo.finance builders

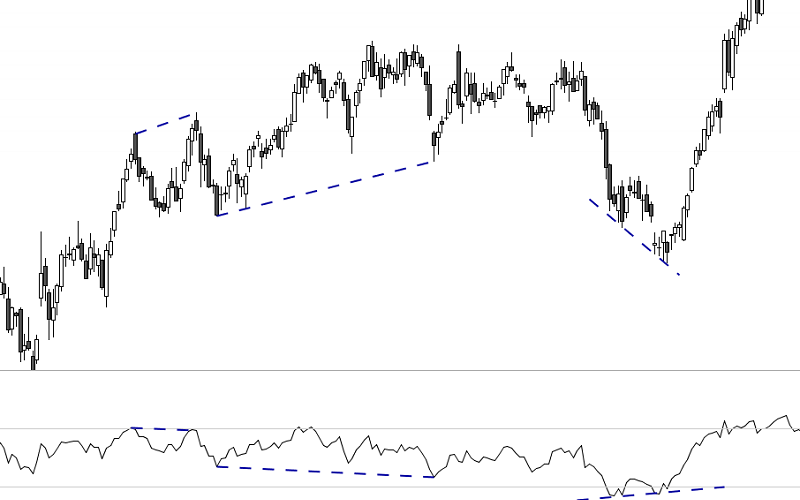

Hidden Bullish Divergence cleo.finance - Building open conditions

Customizable Parameters

There are four options which can be modified to tailor divergences.

Lookback Range (Period)

This parameter determines the amount of time that strategy must be looking for divergence. The default value is 60, which means "Look for the divergence at any time within the 60 bar interval that has passed"

Min. Distance Between Peaks/Troughs (Pivot Lookback Left)

This parameter will tell you how many candles have to be put on the left side to allow the pivot point to be verified.

Confirmation bars (Pivot Lookback Right)

This parameter tells you how many bars need to be added to the right side to ensure that the pivot is located. Follow the recommended crypto trading for more advice including rsi bullish bearish divergence, robot trading on binance, forex automation software, arbitrage in cryptocurrency, auto buy sell binance, binance copy trading, best robot trader software, binance futures trading, mt5 indicators, automated currency trading, and more.

Timeframe

In this section, you can specify the time frame within which the divergence will take place. This timeframe can be different from the execution timeframe of the strategy.Customizable parameter settings of divergences on cleo.finance

The Divergences parameter setting for cleo.finance

Every peak and trough of the divergence is defined by the two pivot points. Maintain the default settings of the bullish Divergence

Lookback Range: 60

Min. Distance between the troughs (left), = 1

Confirmation bars (right), = 3

This means that the divergence troughs are to be within 5 bars of each other (less than one bar on the left, or three bars to the left). This applies to both troughs located within the past 60 candles (lookback period). This divergence can be confirmed three bars after the closest pivot points were identified.

Available Divergencies In Cleo.Finance

They are typically employed in conjunction with RSI Divergence as well as MACD Divergence. However any other oscillator can be evaluated and live tradeable using the automated trading platform cleo.finance. Check out the best trading platforms for site info including beincrypto telegram, trality crypto, cheapest crypto exchange, forex options, ftx crypto exchange, metatrader 5 cryptocurrency, cfd trader, crypto simulator app, auto pilot trading forex, bitstamp auto trader, and more.

In Summary

Divergences can help traders add an important tool in their arsenal. However they should not be used without careful plan. If you keep these aspects in mind, traders could possibly use divergences to their advantage in making better informed decisions in trading. A methodical and systematic approach to divergences is crucial. Utilizing them with other forms of technical and fundamental analysis - like Support and Resistance lines, Fib retracements, or Smart Money Concepts only increases confidence in the validity of the divergence. Learn more about our Risk Management guides on position size and stop loss position. With over 55 indicators for technical analysis including price action, candlesticks, and candle sticks data points you can immediately develop your best divergence trading strategies. We're always working to improve the cleo.finance portal. We would appreciate your feedback whether you have a need for an indicator, data point or other details. |

|

Heure de publication 2023-1-15 15:43:20

|Afficher seulement les publications de l'auteur

|Decroissant

Heure de publication 2023-1-15 15:43:20

|Afficher seulement les publications de l'auteur

|Decroissant